How to quickly implement a Customer Information File

- 02.12.2022

- 3 min

One of the essential elements of banking or leasing systems is the customer information file (CIF). As part of the Task Manager module, Fintin speeds up case handling and related processes by combining data from other systems, platforms, or microservices into one, holistic 360 view of all services, contracts, fixed assets or counterparty requests.

What is the so-called Customer Information File (CIF)?

A CIF is nothing more than a system that consolidates all information about a customer or counterparty and combines it with basic demographic information to create an up-to-date picture of their relationship with their bank, leasing company, or insurer. A well-prepared customer information file effectively supports operational activities, allowing financial institutions' staff to base their activities on current, up-to-date data, without losing sight of historical or archival information.

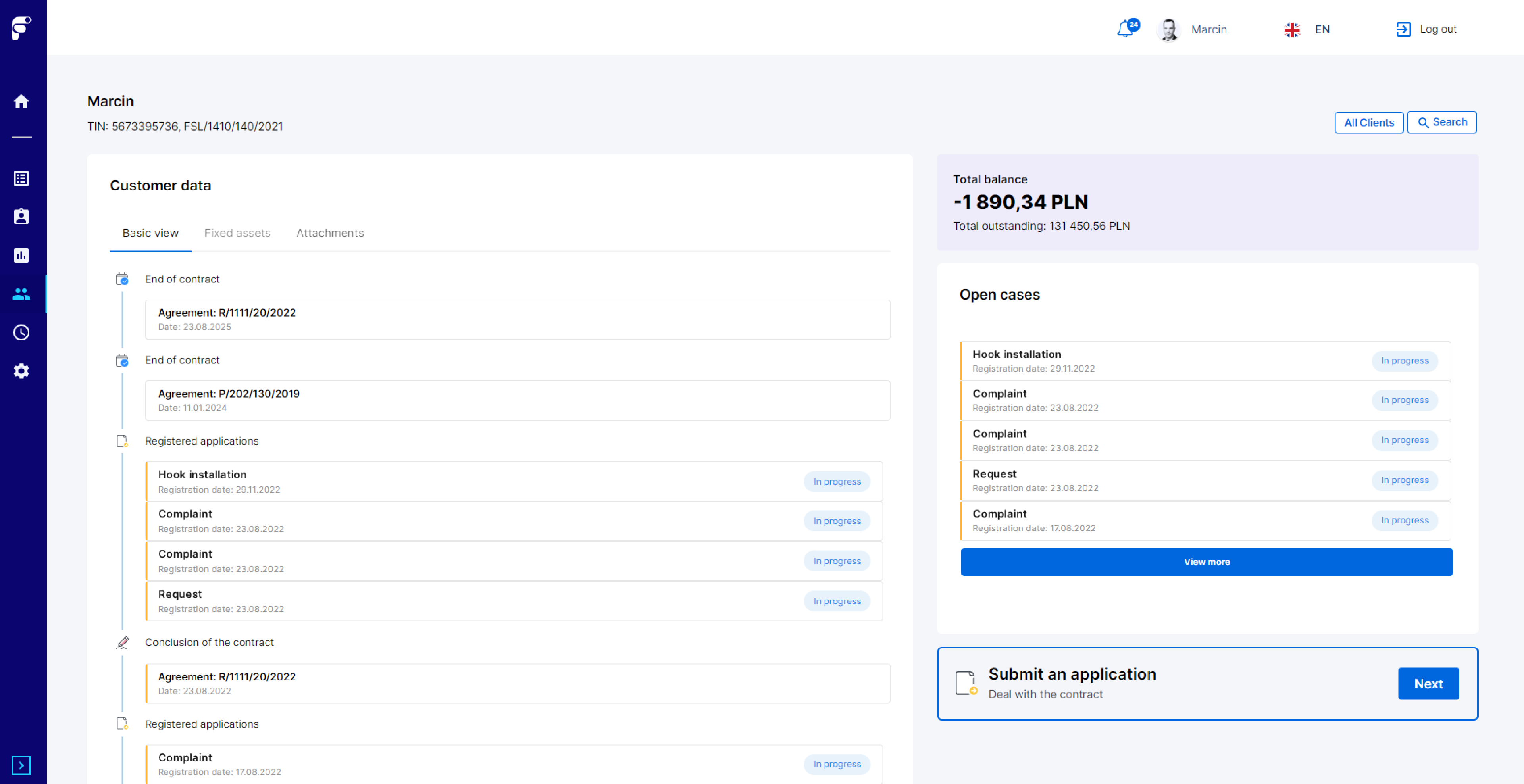

In Fintin, the customer information file is one of the sub-modules of Task Manager, a module that facilitates and automates the handling of a case. It is the central place where you will see the relationship history with a given entity, in the form of a 360 view. It is worth mentioning that, unlike some other applications of this type, in Fintin we distinguish between counterparties and customers, offering banking institutions a different level of detail in the abbreviated 360 view, above all those for after-sales service.

As with other Fintin modules or sub-modules, the CIF can be deployed in almost any environment, integrating with selected platforms, systems, and applications. Furthermore, although it is part of Task Manager, it can even be deployed independently. This provides the opportunity to use the customer/counterparty file in a way that fits precisely into the operational activities of a financial institution or insurer.

360 view of all customer and counterparty issues

Using the customer/counterparty file sub-module, all processes related to handling a given account can be carried out more quickly and efficiently. The 360 view gives us instant insight into, among other things:

- All contracts concluded with our company;

- The entire timetable of the company's relationship with a given customer or counterparty;

- Contract balance;

- All fixed assets;

- All proposals, together with the status of their implementation;

- Information from integrated systems, platforms, and applications.

Fintin securely stores all data, including that reported in external systems or its own microservices or modules. This gives the company a holistic view of the situation of a given relationship, allows it to make more accurate and faster decisions, and, as a result, reduces the time required for each element of the process, improving the customer or counterparty experience, increasing their trust and streamlining all post-sales and ongoing service processes.

Fintin - an innovative financial platform

Fintin helps leasing companies, insurers, car dealers, e-commerce companies, and companies in other sectors to customise financing. It is a solution where you can provide a comprehensive financing offer and fully configure it with available options.

You can easily customize the service to meet your customers' requirements using flexible modules, each with ready-made, predefined processes and integrations in line with business domains. You can choose all the available modules or just the ones you need, such as virtual lounge, active plug-in, API centre, digital assistant, case handling (Task Manager), intelligent document management module, and open banking aggregator.