Intelligent Documents – Cognitive Automation in Document Processing

- 04.04.2025

- 9 min

Modern organizations no longer perceive business processes solely through the lens of traditional workflows. In 2025, digitalization is not just about automating repetitive tasks; it is evolving towards hyperautomation – an intelligent, comprehensive approach to micro-scale process management, where artificial intelligence (AI) plays a key role.

In this article you will find:

- IDP and Cognitive Automation – document processing in the financial sector

- The new face of Business Process Automation

- How does the Intelligent Documents module work?

- Intelligent Documents in the Fintin ecosystem

- How could the implementation work?

- Organizational challenges in document processing

- A new era in document processing

IDP and Cognitive Automation – document processing in the financial sector

The financial sector – spanning banking, leasing, and factoring – has been implementing automation solutions for years. However, a true breakthrough occurred with the rapid development of AI over the past 10–15 years. This progress is driven not only by the latest language models (LLMs) but also by the gradual integration of intelligent technologies into document processing and business decision-making.

Today, Intelligent Document Processing (IDP) is becoming an integral part of this transformation, introducing advanced document and data analysis. Combined with traditional automation tools like Fintin and Camunda, it forms the foundation of a new approach to business processes. While full hyperautomation, where systems not only process data but also make independent decisions, is still ahead of us, IDP is bringing us closer to this vision of cognitive process automation.

A cognitive process involves the ability to perceive and interpret information to draw conclusions – but without making decisions. In other words, it is the analytical stage that enables content understanding without yet initiating action. In the context of IDP, this means the ability to automatically read and interpret structured and unstructured documents.

SensID technology stands out in processing unstructured documents such as contracts, invoices, and business correspondence. This allows not only for extracting key information but also for understanding its context within a broader business process. As a result, organizations can efficiently analyze and classify documents, following a cognitive processing model that forms the foundation of intelligent automation.

The speed and accuracy of document processing are critical for the financial sector. Any delays or errors in manual data entry can lead to operational issues, customer dissatisfaction, and even legal risks. The Intelligent Documents module enables financial institutions to automate document-related processes – from content extraction and analysis to classification and integration into any system.

The new face of Business Process Automation

Employees spend hours manually copying data and searching for documents across scattered systems. According to the Adobe Report (2023), 76% of employees spend up to three hours daily on these tasks, and nearly half (48%) struggle to quickly find the necessary files. The scale of the problem is enormous – Fortune 500 companies lose $12 billion annually due to inefficient document management (Signhouse, 2024).

Our Intelligent Documents module addresses these challenges.

How does the Intelligent Documents module work?

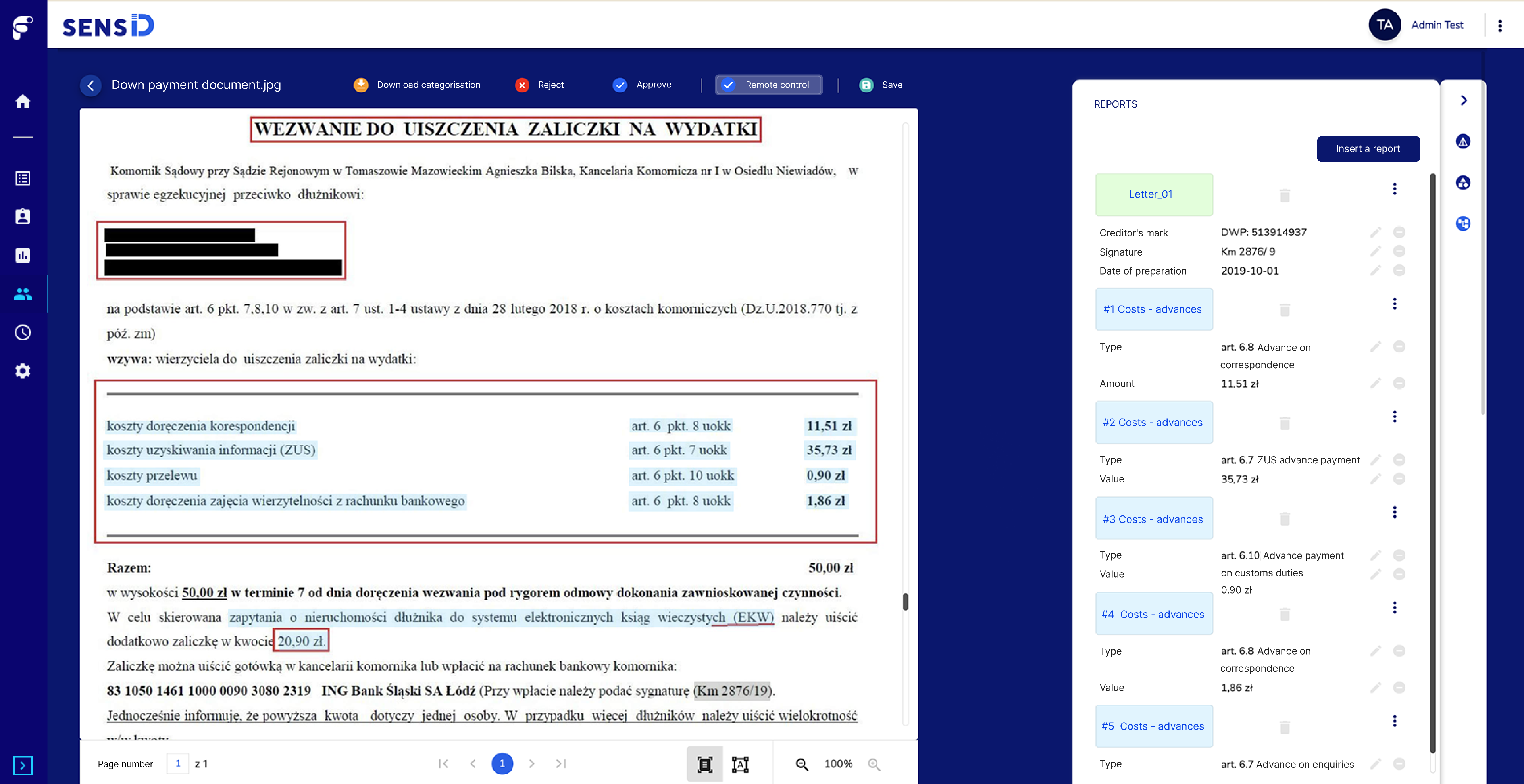

As a part of the Fintin platform and powered by SensID technology, this module automates document reading, analysis, and interpretation using AI-driven models that extract key information from unstructured documents.

The process works as follows:

- Document Digitization – OCR (Optical Character Recognition) converts images into text for further processing.

- Document Categorization – The module automatically recognizes and classifies documents by type (e.g., invoices, contracts, purchase orders).

- Key Information Extraction – The system analyzes documents and extracts crucial data such as amounts, dates, names, and reference numbers.

- Data Integration with Business Systems – Processed data is transferred to Fintin modules like Task Manager for further business use.

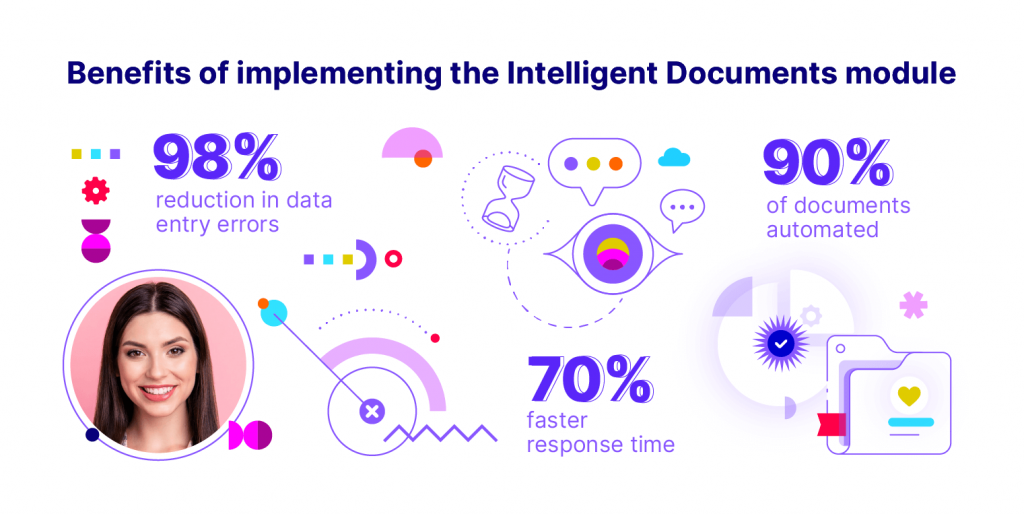

By utilizing the Intelligent Documents module, companies can automate tedious tasks, boosting efficiency and minimizing human error.

Intelligent Documents in the Fintin ecosystem

The integration of Fintin, Camunda, and SensID enables effective document management within business processes, merging traditional automation with cognitive content understanding. In conventional approaches, the first step is process digitalization and structuring, ensuring repeatability and procedural management. The next step is leveraging the Intelligent Documents module to automate tasks traditionally handled by employees.

When a document enters the process—regardless of its source (customer portal, email, internal system)—Fintin can automatically forward it to SensID. The module recognizes the content, classifies the document, and determines its next steps.

This enables organizations to:

- Automatically initiate new processes – For example, when an email with a document reaches customer service, SensID classifies its content and triggers the appropriate process in Fintin, such as handling a complaint, responding to a law enforcement inquiry, processing a leasing fine, or approving a cross-border travel request.

- Enrich existing processes with data – If a document enters an ongoing process, SensID extracts and transfers key data for further processing, eliminating manual entry.

SensID's greatest advantage over classic OCR solutions is its ability to analyse unstructured documents. This means that the system does not require a strictly defined data format - it can recognise and interpret different types of documents within a given domain. In organisations where document circulation is intensive and repetitive, such a solution significantly increases operational efficiency, reduces human error and speeds up information processing.

Fewer errors, more time for strategic initiatives

The Intelligent Documents module automates official document processing, eliminating the need for manual data entry. Once the required information is defined, the system takes care of the rest, allowing financial institutions to focus on strategic business decisions rather than administrative tasks.

Legal documents, forms, and policies are automatically stored in the desired format or placed into predefined response templates. Our IDP technology gathers information from various sources and customer communication channels, ensuring teams always have access to up-to-date and standardized data.

Additionally, the module seamlessly integrates with existing IT systems, eliminating the need for process overhauls. It supports multiple document formats from various sources, providing greater flexibility, enhanced customer service quality, and reduced error risk—all leading to significant time and cost savings for organizations.

Automation of cost estimate and invoice processing for servicing leased and long-term rental vehicles

The Intelligent Documents module can be utilized to automate the handling of cost estimates and invoices in vehicle servicing processes. Currently, many leasing and fleet management (CFM) companies face the challenge of manually analyzing these documents, requiring employees to assign services to the appropriate service categories and approve costs.

How could the implementation work?

Using a prepared set of sample cost estimates and invoices from various service providers, we train an AI model. The model does not require a large number of documents to learn and process them effectively—around 100 documents are sufficient.

The AI model analyzes the content of cost estimates, such as “periodic inspection” or “labor hours”, and assigns each service to the appropriate service category. By leveraging a cost matrix modeled in Fintin, the system automatically verifies whether a given expense falls within the predefined range. If the cost is within limits, the document can be approved automatically. If there are discrepancies, it is forwarded for manual verification by an employee.

Automation of fine processing in leasing

Another leasing industry process where the Intelligent Documents module proves highly effective is fine processing, especially for foreign fines. Handling fines can be challenging due to their non-standardized formats, variations in language, and the time-consuming, error-prone nature of manual processing. By implementing our module, it becomes possible to automate the identification of key information and correctly assign fines to the corresponding vehicles and lease agreements.

The system can automatically process incoming fines and extract key information such as: vehicle registration number, date and location of the offense, fine amount and issuing authority. This allows fines to be automatically linked to the corresponding vehicle, leasing contract, and client. As a result, important information can be quickly and accurately forwarded to the lessee without requiring manual processing by employees.

Automating this process can significantly reduce the time required for fine management, minimize errors, and enhance transparency in document handling.

How to prepare for implementation?

A successful implementation requires an analysis of business processes and the definition of a use case that will bring the greatest benefits to the financial institution through document automation. The next step is to feed the AI model with documents that will be used in the process. Since the model must be trained on real data, it is essential to label the data and prepare a set of test documents. The data can be utilized within Fintin modules, or, if the solution is integrated with existing systems, it can not only be presented to users but also automatically forwarded for further processing as part of business process orchestration.

Organizational challenges in document processing

Document automation offers numerous benefits, but it also comes with challenges that must be considered.

First and foremost, documents vary significantly—they may include tables, stamps, and even blurred text, making it difficult for algorithms to read and interpret them accurately. Another challenge is understanding context—systems must not only recognize text but also identify differences and relationships between data, which is not always straightforward.

Additional difficulties arise from integration aspects, such as the need to retrieve, process, and verify documents, as well as correctly register data within the system. Error handling is also crucial, as the level of trust in accurately processed text must be high. Another key aspect is scalability—the infrastructure must be capable of handling an increasing number of documents efficiently.

When it comes to sensitive documents, data protection becomes a critical issue – in such cases, it’s not always possible to use external solutions, especially those that process data outside the client’s environment and transmit it externally. Companies must also strike a balance between costs and benefits when evaluating whether document processing automation will truly deliver the expected savings.

Business Process Automation – Intelligent Documents and Camunda

By integrating our module with Camunda, businesses can enable smart document management, regardless of the source—whether it’s a customer portal or email. Fintin retrieves documents and, using the Intelligent Documents module, analyzes their content. Based on the results, Camunda initiates or enhances business processes, ensuring seamless workflow automation.

A new era in document processing

Implementing the Intelligent Documents module is a step into the future—where employees no longer waste time on manual data entry, and documents are processed quickly, accurately, and without errors. Automation not only speeds up operations but also makes organizations more agile and prepared for changing market conditions.

In the digital era, investing in intelligent document processing is no longer just an option—it’s a necessity for any modern financial institution. Want to optimize your document processes? Contact us today and discover how we can boost efficiency in your financial institution!