Pay-as-you-go, circular economy – innovations in leasing

- 09.05.2024

- 5 min

Addressing growing customer demand for convenient and flexible solutions, we are proposing an innovation in financial offers that combines leasing, pay-as-you-go concepts and the circular economy. Is dynamic instalment the future of leasing?

Using data for a better customer experience

Optimising business processes is becoming a key factor in building lasting customer relationships. Data integration plays a vital role in this process, providing the ability to personalise offers and respond quickly to changing customer needs. According to recent research by the Polish Leasing Association, the progress of digitalisation in the industry will continue, with leasing companies becoming more advanced in collecting data on assets, their use and consumer behaviour, aiming to improve and personalise offers with their customers in mind.

Harnessing data and modern tools can transform the financial industry with dynamic offers tailored to the changing needs of customers.

Marcin Majka Product Manager of Fintin

New approach to business model

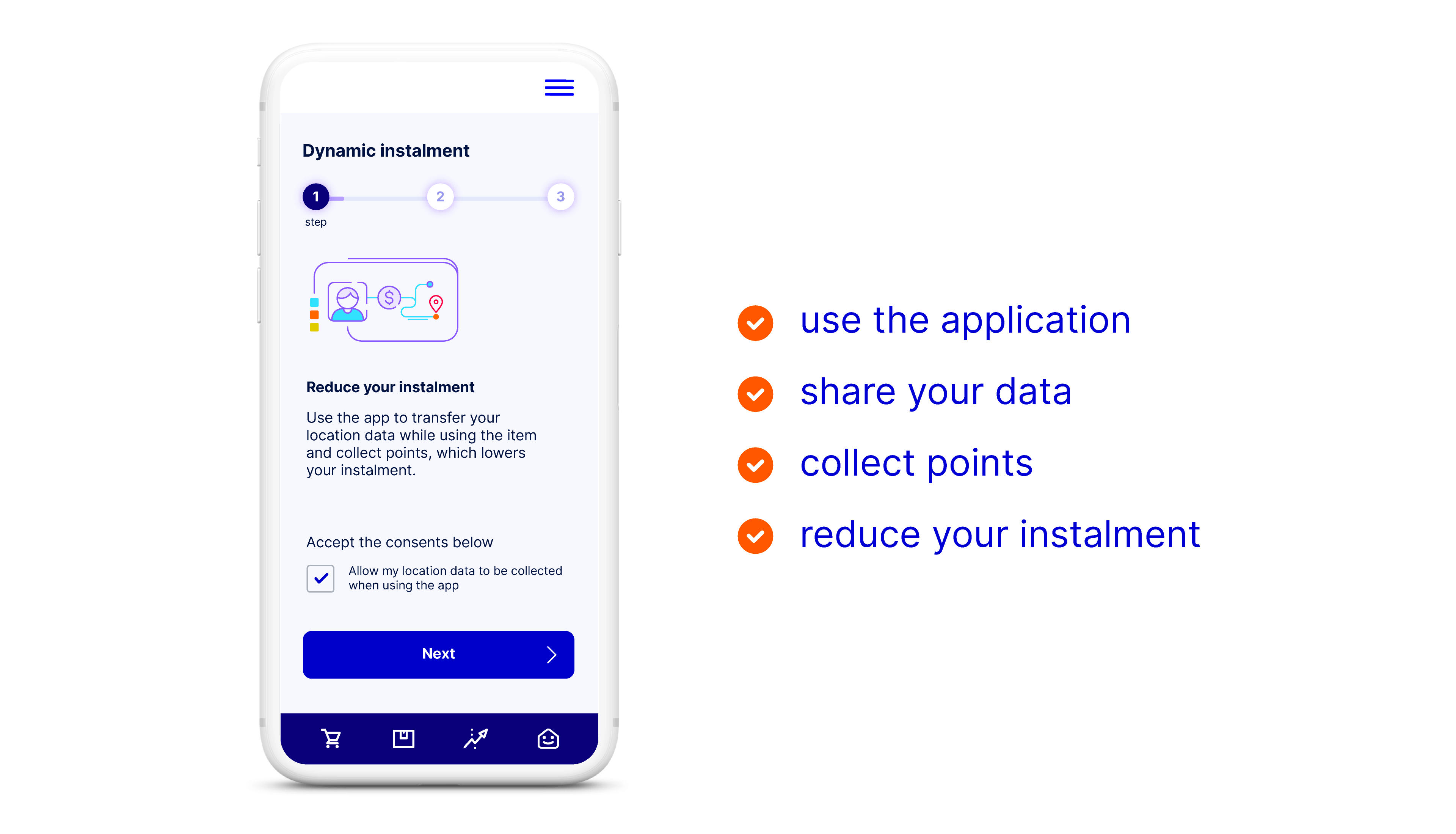

During the e-Leasing Day 6.0 conference, Marcin Majka presented an innovative concept for an application that allows customers to precisely track leasing/rental costs based on the concept of a ‘dynamic instalment’ calculated with AI. The lease is currently being compared by customers to a subscription – a study by DigitalPoland revealed that up to 81% of respondents prefer subscription services, which offer greater convenience and flexibility in use. Following this growing trend, TUATARA is proposing to start thinking of financial services as a subscription but based on a ‘pay-as-you-go’ concept – basically you pay as much as you use.

How could this look in practice? If a customer allows the financier to obtain the relevant data from the app, then points will be collected and it will be possible to reduce the instalment, i.e. the customer will benefit from a dynamic instalment. For that, information on how the customer uses the vehicle, whether they drive ecologically, whether they service the vehicle according to its wear and tear, how often they use it, etc., will be crucial.

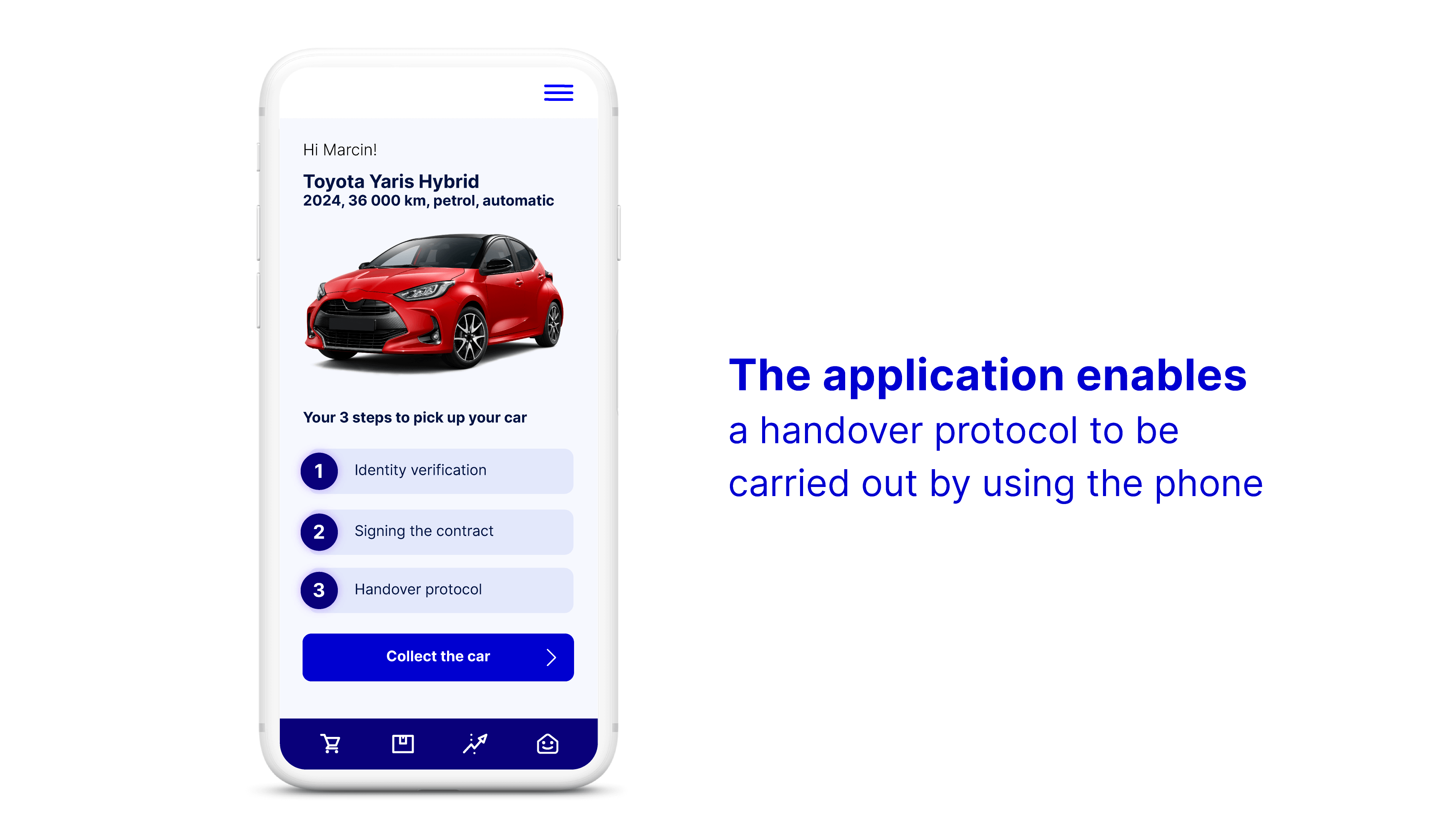

What are the additional benefits of using the app? It will become the main point of contact between a lessor and a customer. If it is already available at the contracting stage, it will provide the institution with easy verification of the customer's identity, the implementation of paperless transactions, the formalities for the collection of an asset – such as a car. Thanks to the use of artificial intelligence, the handover protocol can take place with just the phone's camera!

Profit sharing with the customer – is it possible?

Currently, financial products consist of three main elements: the basic financial offer (such as the number of instalments and the residual value), the capital and interest part and additional services and products that are included in the budget, which includes maintenance and insurance, as well as a margin and administrative fees.

Our proposition is an intermediate model in which the analysis of the vehicle's exploitation is not based on average monthly costs, but on actual exploitation details downloaded from the app and confirmed by service data. This allows the financial institution to offer a more personalised solution to the customer, with the budget calculated on the basis of the company's historical data on additional products.

The usage of data and sales automation allows processes to be optimised and profits could be shared with the customer. This model is a unique proposition, in line with the trends shaping the modern economy – an institution that opts for such a solution will certainly stand out in the market.

Circular economy in vehicle leasing

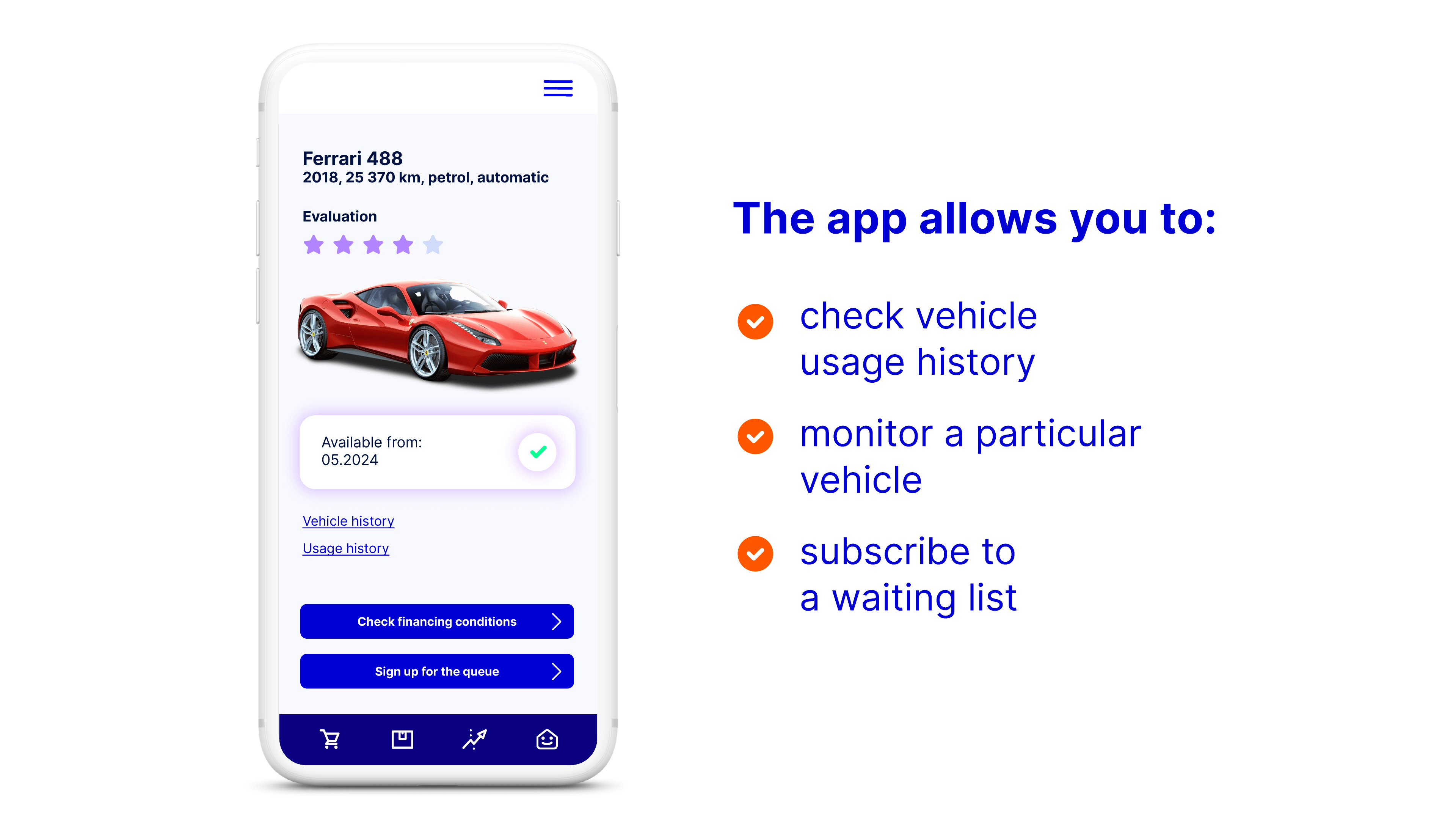

An idea that goes further is a proposal based on the concept of the circular economy in vehicle leasing, in which vehicles would constantly circulate between users instead of remaining unused. Since the leasing institution would already have such precise data about the car, like braking history, driving safety, tyre wear, etc., it could share this information with all its customers, so that they could keep an eye on the car they want to rent.

Reviewing available vehicles is an attractive proposition for new generations entering the market, as it enables them to see the exact history of their dream vehicle while it is still being used by another customer.

Vision for the future in the finance industry, and especially in the leasing industry, lies in the ability to strategically utilise existing resources. Optimising processes to make full use of existing data is becoming a key focus. Leasing companies have a large amount of data at their disposal, which should be the foundation for implementing innovative business models.

Marcin Majka Product Manager of Fintin

According to the cited report by the DigitalPoland Foundation, the most frequently mentioned flaw of subscription services is their excessive price and unfavorable contract terms for regular users. From this point of view, the pay-as-you-go option is becoming an attractive and forward-looking alternative, enabling users to pay only for the actual use of the service. This fits in with the trend towards greater efficiency and flexibility in the vehicle leasing market, shaping informed and desirable attitudes among customers who use leased assets with greater care.

Experts from leasing companies have considered such a solution, but so far none of the players have decided to implement it. The key barrier is formal requirements, including the need to change the approach to calculating the lease instalment, estimating the residual value and the possibility of concluding contracts remotely. For a long time, the Polish Leasing Association has been pushing for changes to how contracts can be signed on paper. The leasing industry is heading towards more digital processes, environmental care, and smarter asset utilization. This shift is unstoppable. That's why, as the Polish Leasing Association, we're happy that the switch from traditional to digital leasing agreements is part of the deregulation bill. We're excited for the legal changes expected later this year.

Monika Constant President of the Polish Leasing Association