Embedded Finance – a new factoring model

- 10.01.2023

- 6 min

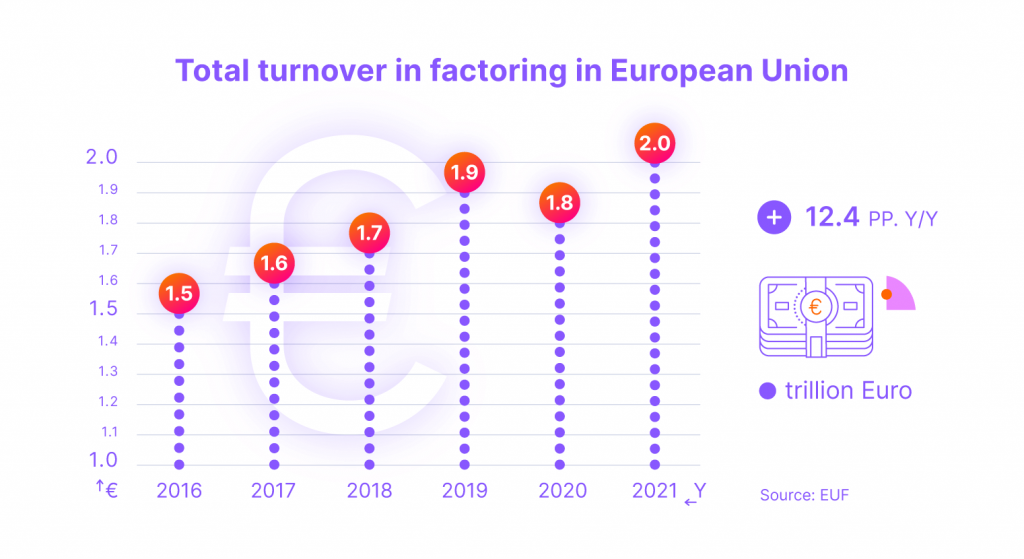

The difficult geopolitical situation, uncertainty or rising inflation levels translate into less investment activity by companies. Companies are abandoning investments, mergers and acquisitions and their liquidity position is deteriorating. Instruments that improve companies' liquidity, such as factoring purchase financing and deferred payments, also known as BNPL (Buy Now Pay Later), are becoming increasingly popular. According to the EU Federation for Factoring and Commercial Finance (EUF), the turnover of factoring companies in 2021 increased by as much as 12 percentage points and the total value of the European factoring market in 2021 was more than EUR 2 trillion (compared to EUR 1.8 trillion in 2020). In the following year, the growth was even more dynamic. The Polish Factoring Association reports that in the first two quarters of 2022, factoring companies purchased receivables with a total value more than 33 per cent higher than in the corresponding periods of 2021.

In this article you will find:

Buy now, pay invoice later

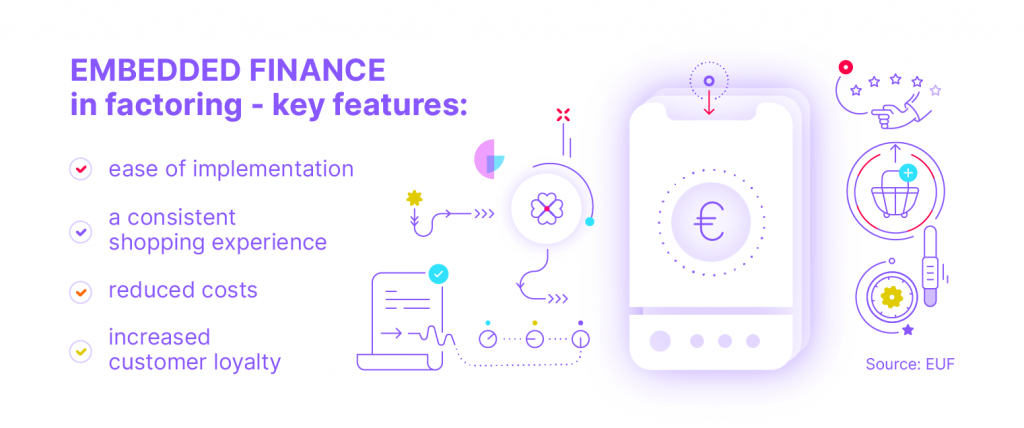

With the greater availability of factoring services a new problem has arisen: how to scale such a business effectively to enable smaller players to benefit? For them, factoring is part of the growing trend of deferred payments (BNPL – Buy Now Pay Later) and they expect the whole process to be as straightforward as possible, preferably within a single digital channel. This is helped by so-called embedded finance, which involves integrating financial products such as factoring, loans, leasing, insurance, debit cards or investment vehicles with almost any non-financial product.

In other words, this means providing financing services in a sector whose core business is not of this nature. This is crucial, for example, in e-commerce services, where both revenue and customer loyalty depend on the timing of transactions. It also makes it possible to transparently link business-focused financial services (e.g. factoring) with the e-commerce sector. This is not only the case with the factoring service; deferred payments are an increasingly important area of activity for those operating in leasing, banking or payments.

Today, BNPL's services are not only aimed at individual customers, but also at entrepreneurs who, using various e-commerce or marketplace platforms, procure the necessary equipment and devices, complete office furnishings or make other purchases. While in the case of B2C solutions on the market, the customer often does not pay for deferred payments, in a B2B relationship, the costs of such financing are incurred. This is due to the increasing number of regulations and requirements that financing companies have to meet, such as AML (Anti-Money Laundering) and KYC (Know Your Customer) processes, which confirm the reliability of the customer and allow identity verification.

Embedded factoring

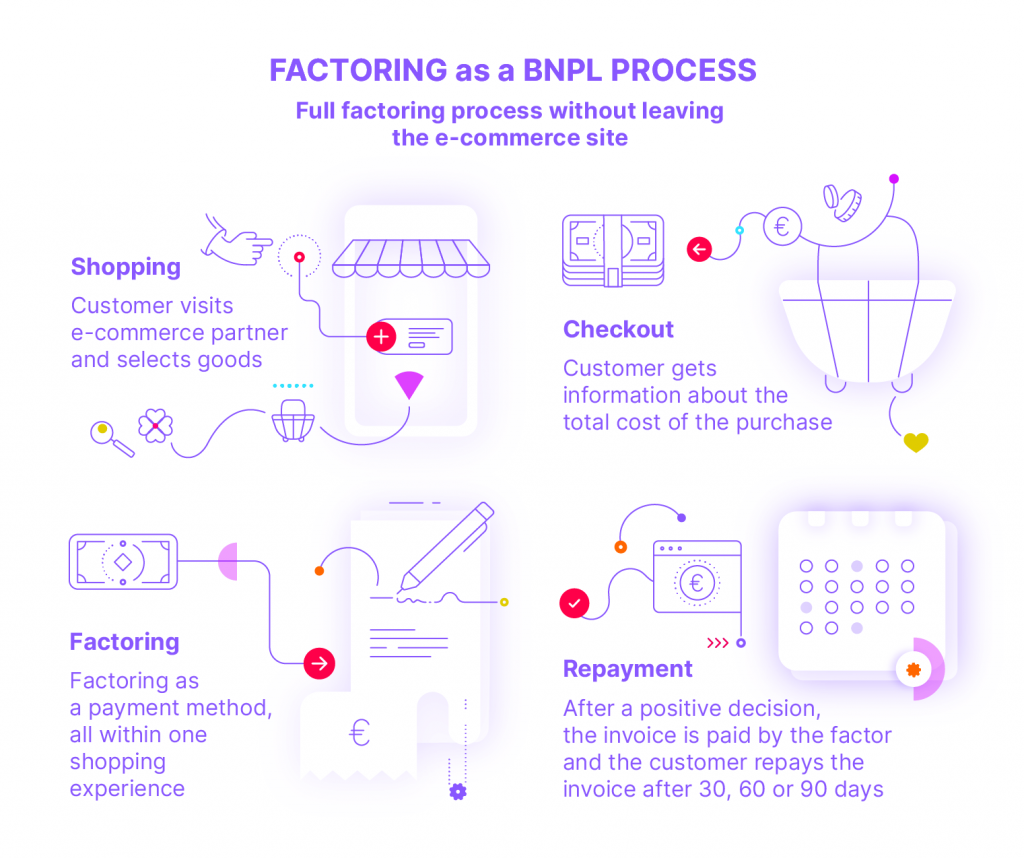

Covering credit, installment or loan services in non-financial services and products allows the transaction to be carried out quickly, conveniently and simply. In this situation, the financier is almost 'transparent' to the buyer. In terms of the customer experience, the entire purchase path takes place within a single system and does not differ significantly from a normal purchase. It only requires selecting a few additional options and obtaining a credit decision – but this is issued within a few minutes.

Factoring services, however, differ from other financial mechanisms used to improve the liquidity of companies. Traditionally, they require the factor to scrupulously check the other two parties – the company using the factoring services and the invoiced company. The need for meticulous analysis of documents, also in terms of fraudulent or empty invoices, and the bank-like procedure of checking the financed party for financial credibility, mean that the expenses incurred per transaction can be very high.

For this reason, factoring services for micro, small and medium-sized companies, where the single invoice value is relatively low, were often simply unprofitable for large factoring companies. Nowadays, thanks to the use of technology and a change in the approach of factoring companies to smaller counterparties, it is possible to largely automate the entire process. For micro-entrepreneurs, the decision time for a factoring company has been reduced to one day and, in many cases, even to a few tens of minutes.

It is worth remembering that factoring companies' cooperation with smaller customers is not only about simplifying procedures. It is also the need to contact them through channels other than traditional ones - the use of factoring must be based on a similar purchasing path as other BNPL processes. The factoring service should therefore be available in an accounting application or on a target e-commerce sales platform that allows you to pay for business purchases in a fast online process.

Is it possible to embed factoring in a similar way to other financial services? Of course, but you have to remember that the whole process (invisible to the customer) is much more complicated. In order to effectively scale the factoring business in the SMB sector, it is necessary to fit in with the growing BNPL trends, while at the same time automating back-office processes, especially those that take the most time and involve the most staff, including document reading, data entry, and verification.

For more on the Embedded Finance trend, visit the Fintin platform blog.

Active Plugin – the entire factoring path within one system

In order to facilitate the implementation of the embedded finance concept in various financing sectors, we have developed the active plug-in and we have made it available as one of the modules of the innovative Fintin finance platform. What is the active plug-in and how does it work?

With an Active Plugin, the entire product purchase path is available within a single system - be it an e-commerce partner, shop or accounting platform. From the user's point of view, it handles the moment of product selection, purchase, choice of financing method, as well as finalisation, within a single purchasing experience.

As a result, the user is not transferred to other sites, which benefits their digital experience and prevents the transaction from being interrupted and in two places - the e-commerce part and the product financing part. The Active Plugin is a de facto ready-made widget that, by pasting a short code into the page, allows a quick integration with the API and automates the entire sales and financing process. Our module guarantees the integration of any purchase financing method into the selected website or application.

The main features of the Active Plugin:

- Freedom of implementation – can be implemented as a sidebar, pop up or page element.

- Configurable parameters, including a financial calculator to determine the financing time of an invoice or additional packages.

- Integration with the application submission form within one system – ensures the continuity of the digital user experience.

- The opportunity to test various parameters of the application before submitting it and finalising the entire purchase process.

- It is built in a plug&play formula, which means that it works as soon as the relevant script is pasted into the page without any interference with its configuration.

- Interaction with other Fintin modules – it can be configured, for example, with the module responsible for notifications, which allows personalised notifications to be sent to the user.