Embedded Finance – the revolution in online financing

- 10.05.2022

- 4 min

Customers expect the merchant to offer convenient and simple payment method when shopping online. How do you provide customers with the best shopping experience? The answer is Embedded Finance, an almost invisible to the end customer combination of a non-financial service provider with external leasing or credit service.

In this article you will find:

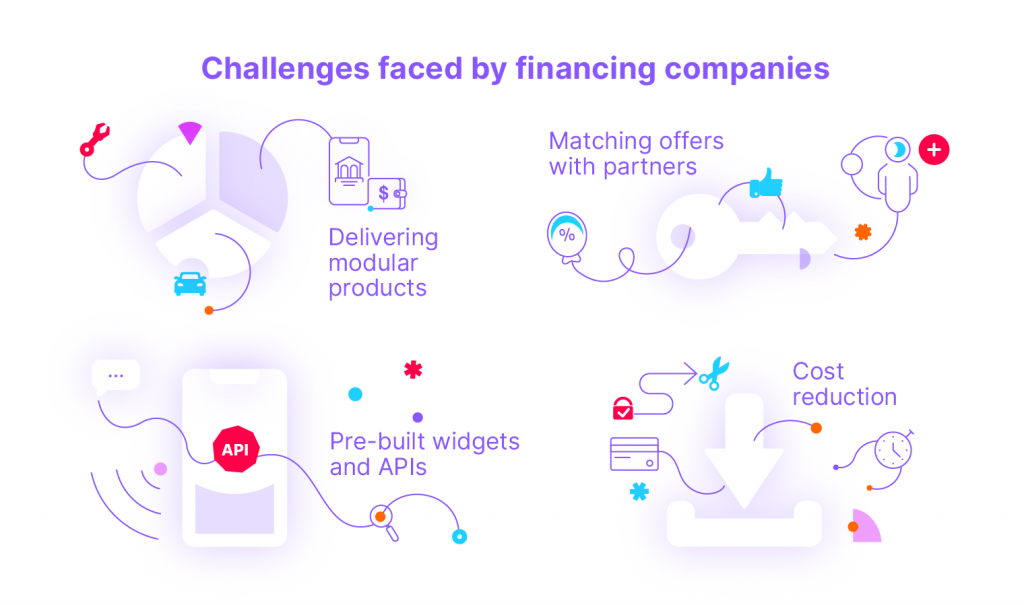

The challenges that financing companies face

Embedded Finance means simply offering a financing firm's products in other companies' channels, e.g., retailers or e-commerce. In other words, it's the delivery of financial products, such as banking and credit services, policies, or leasing, within the ecosystem of an entity whose core business is something else. It's a synergy between a bank, leasing, or insurance company and, say, an auto dealership, a transportation services company, an auction platform, or any other e-commerce business.

So far, these types of solutions have been used mainly by companies in the so-called disruptive economy, start-ups that have used banking products to facilitate customer payments – whether by simply sewing in a payment gateway, introducing a virtual purse, or a Buy Now, Pay Later (BNPL) service. Other market participants also recognize the advantages of companies financing and offering goods or services in e-commerce. Customers expect complimentary products, a combined offer of non-financial and financial products in one place. Providing them with a unified, enchanting experience is the biggest challenge and a necessity for companies operating in the digital world.

The industry's problem just a few years ago was the lack of mechanisms by which making financial services available could bring real economic benefits. Implementing such tools required a significant commitment, both from the finance company and its non-financial partner. The development of APIs has effectively eliminated this problem and opened up the world of Embedded Finance to smaller entities operating in the digital space.

However, for this to be possible, in addition to the availability of the product itself (e.g., leasing or insurance), finance companies, the insurance or banking industry must be ready not only to adapt their products to the requirements of non-financial companies and their clients but also to provide technology - APIs, widgets, mechanisms that facilitate the automation of tasks (e.g., automatic form filling, a friendly virtual assistant that allows the client to go through the entire process painlessly), or financial modules tailored to the specificities of a particular partner.

Who will benefit from the trend of embedded finance?

Embedded Finance - a win-win-win situation

Embedded Finance is much more than that, however. First and foremost, it allows organizations to launch new revenue streams. Linking finance to non-financial activities such as sales or services can be done to the benefit of all participants in the transaction - the company will make money from offering financial services to the lessor, the lessor will almost seamlessly acquire a new customer, and the customer will receive an easier route to finance, a better, more consistent buying experience and more attractive terms.

Benefits for Customers:

- Better buying experience

- Quicker acquisition of financing, often on better terms

- Convenience

- Faster and easier transactions

Benefits for the company using embedded finance:

- New sources of revenue, e.g., by gaining commissions on the sale of financial products

- Possibility of easy co-selling of financial products or value-added products

- Increased customer loyalty and CLV (Customer Lifetime Value)

- Possibility of obtaining data on customer groups, facilitating behavioural segmentation, and a better understanding of purchase behaviour

Benefits for the financing company:

- Easy and cheap acquisition of new customers, simplified onboarding process

- Secure verification and authorization of loan or leaseholder data

- Increased availability of financial products

- Ability to offer financing exactly where customers need it

Security and regulatory compliance

When choosing a technology provider, it's also worth paying attention to their approach to regulation. Financial service providers must comply with regulations, especially regarding selling products to customers and treating them fairly. Given the sensitive nature of the information they hold, protecting that data is crucial. Data compliance is essential to avoid penalties and build relationships based on trust.

Fintin is our answer to these challenges. It's a fully secure and market-ready solution, fully compatible with various security standards for the financial sector, including PSD2, OWASP ASVS, and regulations for cloud computing in financial institutions. Our platform has ready-made modules, among others, adapted to PSD2 requirements for secure and standardized data exchange between banks. Fintin gives you the confidence to achieve a competitive advantage without forgetting the necessary security measures.

Fintin is a flexible solution that adapts perfectly to the individual needs of financial service providers, car dealers, brokers, and their customers. It uses cognitive technology to help optimize processes, especially in customer communication. Thanks to our innovative platform, financial service providers can conduct multi-channel communication based on conversational mechanisms. Customers can also count on support at every stage of the purchasing process and after-sales care.