Fintin – end-to-end financing wherever you need

- 02.12.2021

- 5 min

The technological change is happening now - from innovations that were already taking place to those starting to emerge in response to customer demands; the financial sector is constantly developing. Cash payments, face-to-face meetings with consultants, even cash withdrawals from ATMs, are all things of the past. Instead, the focus is on digital interactions. How can companies ensure they thrive in this unpredictable environment? Fintin, our innovative financial platform, is an example of a solution supporting modern technological changes.

The digital revolution in the everchanging world

Boosted by rapid technological development, the financial services industry has evolved incredibly during recent years. They embrace disruption, especially regarding the role, structure, and competitive environment within the markets in which they operate. Financial institutions have been adjusting their business models accordingly. The accelerating pace of technological change is what drives the financial services ecosystem today.

Looking into the past and the future, we know that technology will only play a bigger role across all business sectors, and the financing sector is no different. With that in mind, we've come up with a comprehensive solution that answers the digital revolution’s needs. Fintin, our financial platform, accelerates various sectors, including automotive, to the next stage of the technological race. We're here to catalyze the synergy between the automotive and financing sectors by offering a solution that effectively presents vehicles together with their financing options.

Fintin – a complex financial platform focused on customer experience

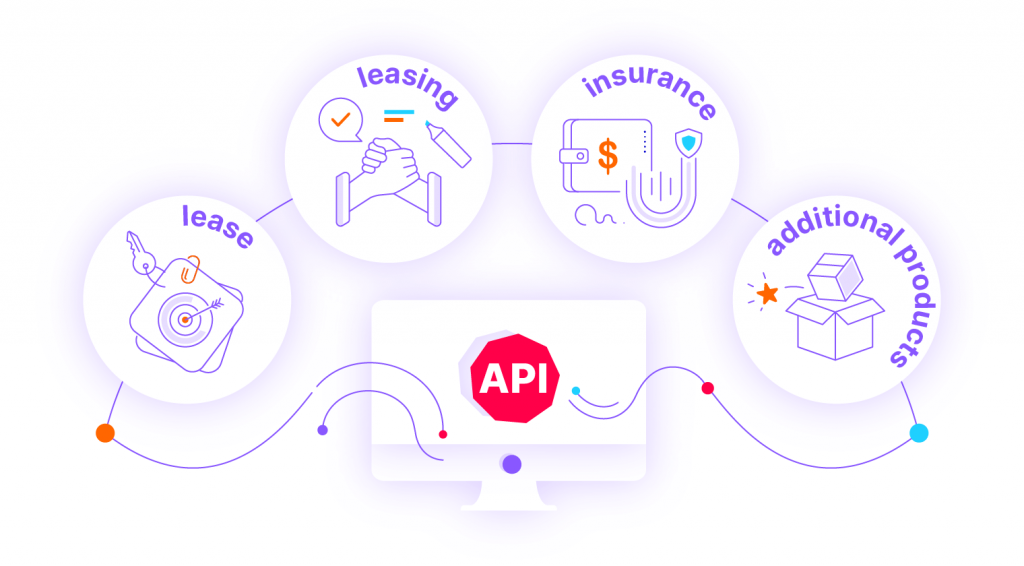

Fintin is a flexible solution dedicated to the financing industry that can perfectly adapt to the needs of financial services providers, car dealers, brokers, and their clients. With ready-to-use and flexible modules, it is a comprehensive solution that can be tailored to individual requirements.

But enough with the introduction. What exactly our solution has to offer?

Personalized offers

Personalization of financing products is a process that has been steadily developing as it captures the essence of what modern consumers expect. Personalized services significantly shorten the distance between a financial organization and its users and are based on trust. The more we trust a product, the more we are eager to share our personal data to receive tailored, highly individualized service.

Fintin offers omnichannel personalization as an answer to the constantly evolving needs of the customers. Not only it uses data analytics and customer segmentation to make the offering best suited to one’s needs, but also it provides the whole database of services to offer.

The Virtual Dealer, one of our financial platform modules, uses a vehicle stock and makes the purchasing decision easier. The preferred product is already integrated with the best possible financing offer. The customer can choose from a variety of vehicles – each one presented with a photo and description. Also, customers can search for a particular car based on individual requirements.

Processes automation

With most activities moving online, process optimization plays a pivotal role in today's world. People expect innovative solutions to be more user-friendly, flexible, and smooth. They don't want to wait longer to finalize the transactions.

Thanks to automation, Fintin answers the customers' needs by providing financial offers without the need to leave the house. Using a proprietary solution that allows interpretation of natural language with the help of AI and ML, it becomes possible to automatically classify documents and data contained in them to automate processes.

Thanks to a pre-integrated connection with tools used by the sales department and open data sources, our financial platform makes it possible to shorten the duration of the purchasing process, which significantly increases customer satisfaction. The shortening duration of the processes starts at the very beginning of the client's financing selection.

Fintin improves the customer experience by using an easy and simple application form. It autocompletes information in the form by downloading data from external systems. The financing decision is automatically examined and sent to the client for a signature – completely online.

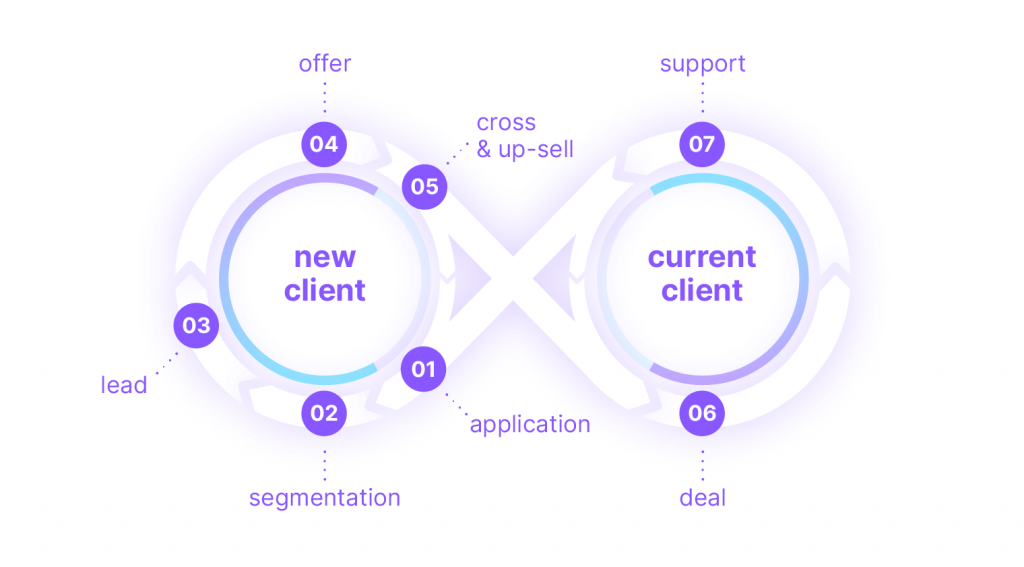

Cross- and up-selling

In financial services, cross- and up-selling processes are often poorly differentiated. Sales typically coordinate these efforts with corresponding geographic or business unit sales teams, and marketing involvement is limited. Cross-sell and upsell program success requires a service-level agreement that establishes complementary roles of sales and marketing.

With Fintin, the products are matched using the best knowledge about the customer. Data gathered and analysed from customer behaviour patterns enables the creation and adaptation of individual segmentation models.

The use of segmentation allows you to reach the customer with the best offer, thus reducing the chances of a transaction failure. Offering additional products and services as part of financing has become an integral part of the vehicle financing market.

Aftersales support

Finally, our solution offers complete digital aftersales support for each client. Fintin, with its ready-to-use modules, takes care of customers' after-sales processes related to contracts and obligations. Thanks to the integration of multiple data sources, our financial platform enables fast and safe implementation of product management processes. Ready-to-use domain modules make it possible to flexibly implement a solution adjusted to the company's IT ecosystem.

Fintin is the one place to monitor customers' payments, submit claims and track their progress. We also offer a possibility to purchase additional products and services during the term of the contract—everything to make sure that the customer is satisfied.

The financial platform that supports the digital revolution

The financing sector faces many challenges. Only with the support of modern technology, it can adapt to dynamic business changes. To stay relevant in the ever-changing world, financing innovations need to keep up. Fintin is an answer to what the industry needs.

If you want to gain a competitive advantage with our innovative solution, contact us for a free demo.