Embedded Finance in factoring – automate factoring services

- 11.12.2023

- 8 min

The factoring industry is experiencing a real revolution thanks to the growing role of integrated financial services, known as embedded finance. They are transforming traditional business models and, together with automation on the Fintin platform, are opening new opportunities. With embedded finance, factoring companies can offer a more personalised service, which in turn can increase customer satisfaction and loyalty and enable digital channel owners to create new revenue streams.

Embedded Finance and the factoring industry

According to Capgemini, 60% of SMEs would like to use integrated financial services to improve their payment processes, and 50% believe it would give them access to better data that can be used to improve operations. So, let's consider how the concept of Embedded Finance can help build, develop and scale factoring services in any online environment.

Embedded Finance is the concept of integrating financial services with other products and platforms that have traditionally not been related to finance. Companies from different sectors can now offer their customers financial services (usually from third parties), such as payments, insurance or loans, directly within their apps or platforms. This approach not only increases convenience for the user but also opens new revenue streams for companies that can now offer additional services.

In the factoring industry, where securing fast funding is crucial, this is a new way to attract new customers and increase customer loyalty, facilitate access to the service and reduce costs. Factoring using Embedded Finance is particularly beneficial for SMEs, which often face liquidity problems and do not have the resources or time to seek alternative forms of financing for ongoing operations.

Thus, it can be said that Embedded Finance is a new ecosystem that brings consistent benefits across the different facets of the factoring industry. For a channel owner, such as an e-commerce platform, this means creating new revenue streams through commissions on factoring transactions, while increasing the value proposition for users. This integration of financial services becomes a competitive differentiating asset, attracting and retaining customers through added value and convenience. End customers, most often representatives of small and medium-sized enterprises, thus gain access to simplified and fast financing for their invoices. The simplified application process, integrated into everyday business tools, saves time and enables better control of cash flow, which is crucial for financial stability.

For factoring companies, on the other hand, using the idea of Embedded Finance means that they can reach new market segments and expand their customer base. In addition, access to transactional and business data allows for a more precise risk assessment and better tailoring of the offer to customers' needs. Integrated systems and process automation contribute to lower operating costs and increase the overall efficiency of factoring operations, which benefits both factoring companies and their clients.

Embedded Finance as a tool for creating new sales channels

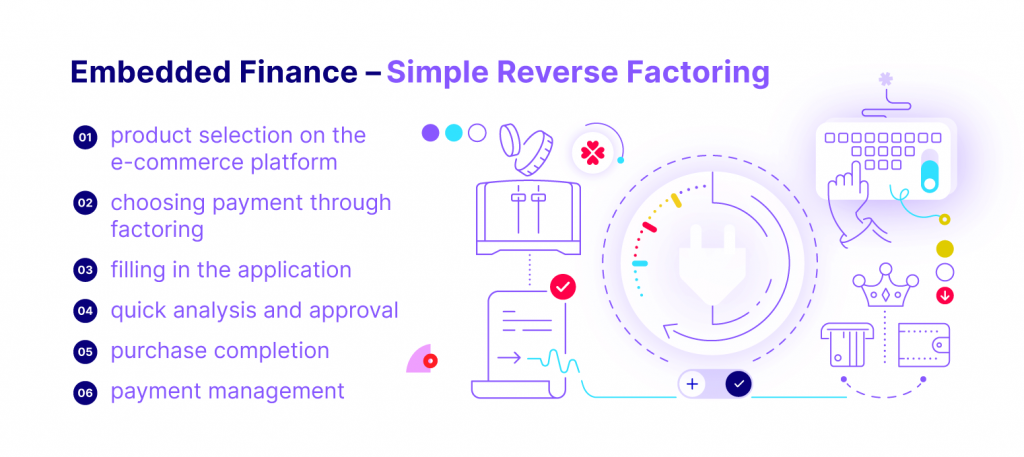

One of the challenges faced by companies offering factoring services is how to effectively scale the business in a way that enables a bigger number of smaller entities to benefit from these services. For these smaller businesses, factoring is becoming part of the growing trend of deferred payments, known as Buy Now Pay Later (BNPL). They expect the whole process to be as straightforward as possible and preferably completed within a single channel. In this context, Embedded Finance is becoming a key solution to integrating financial products such as factoring with almost any non-financial product.

This approach is particularly relevant in the e-commerce industry, where transaction processing times have a direct impact on revenue and customer loyalty. Embedded Finance enables a transparent combination of B2B-focused financial services. It is, of course, worth mentioning that this trend is not just limited to factoring; deferred payments are becoming an increasingly important area of activity for companies operating in leasing, banking or payments.

To help the financial and e-commerce industry easily implement Embedded Finance in practice, we have created the Active Plugin, a module of the Fintin platform designed to support the integration of financial services into various e-commerce platforms and business applications. With flexible configuration options, the Active Plugin allows you to tailor your financing method directly to the user interface of your website or mobile app, providing a seamless shopping and financial experience in one cohesive system.

Using the Active Plugin, companies can offer customers the option of factoring in the BNPL model without leaving their digital ecosystem, a significant improvement over traditional financing methods where the customer is often redirected to external sites. The plug-in, thanks to its integration with Fintin platform modules, also enables any other purchase finance method to be incorporated into the chosen website or app, resulting in faster implementation, lower implementation costs and configurability according to business needs. For more on the Active Plugin module, see the articles Active Plugin - financial services for e-commerce.

Automation of customer factoring processes in any channel

For customers of factoring companies, one of the most important elements is the speed and convenience of processes - this is also fundamental when it comes to using Embedded Finance solutions. Thanks to its modularity, Fintin enables the automation of customer interactions, tailored to the specific needs of the organisation. This, combined with the ability to personalise offers and services, not only increases customer satisfaction, but also contributes to building long-term relationships based on trust and the delivery of added value.

The use of technologies such as AI, machine learning and data analytics enables factoring providers to optimise their business processes, which manifests itself in both increased efficiency and reduced operational costs. The Fintin platform enables the automation of many routine tasks, such as document verification or data classification, allowing teams to focus on tasks that require analytical thinking and decision-making.

Thanks to Fintin's flexibility, integration into factoring companies' current IT ecosystem is simplified, ensuring seamless communication between different systems and databases. This facilitates and speeds up processes such as receivables management, credit risk assessment, and enables more efficient liquidity management. The platform also offers compliance support, ensuring compliance with current regulations and security standards, which is crucial in an industry that relies on sensitive financial data.

Digital Assistant will improve customer service

Factoring companies that provide financing to other entities by purchasing their receivables are particularly prone to bureaucratic complexity that can unnecessarily take up the time of both clients and employees. When using Embedded Finance solutions, it is worth ensuring that the factoring company's customer is going through the entire process as simply, intuitively and smoothly as possible. As part of the Fintin platform, the Digital Assistant, which uses advanced artificial intelligence and Natural Language Processing (NLP) technologies, will come to aid.

The Digital Assistant, running on the Actionbot engine, is revolutionising the way customers interact with factoring companies. Rather than struggling with the intricacies of forms and applications, users can now have an intuitive conversation with a bot that takes them step-by-step through the necessary procedures. This means that the information needed to process the application is collected efficiently and without errors, significantly reducing time and increasing process efficiency.

The advantages of this solution are multidimensional. Firstly, the customer experiences a higher level of service thanks to a simple and user-friendly interface, similar to what customers are already used to (such as communication apps like WhatsApp or Messenger). Secondly, the Digital Assistant automates routine queries and operations, relieving the burden on the factor's staff. Thirdly, the solution provides full flexibility of the system, which can be adapted to the specific needs of the company and its clients and has the possibility to integrate with other modules of the Fintin platform. This comprehensive approach to process management not only speeds up service, but also opens the door to further automation and optimisation of operations.

In the context of Embedded Finance, where financial services are embedded directly into various business platforms, the Digital Assistant is an ideal element to increase the fluidity of financial operations and the accessibility of services. It enables factoring companies to offer their customers modern and convenient solutions that are not only in line with current digital trends, but also make a real difference to the quality of service and user experience.

Read more about Digital Assistant on our blog.

Summary: Embedded Finance in factoring

Embedded Finance is changing the rules of the game in the B2B world, offering new opportunities for factoring companies and their customers. Integrated financial services not only streamline operations and reduce costs, but also open new revenue streams and opportunities for personalised services. In an era where personalisation and efficiency are key, embedded finance is becoming an integral part of the financial ecosystem.

Additionally, with Embedded Finance, finance companies gain access to large amounts of customer data from a variety of digital channels - this data can be used to create insightful analyses and reports to help better understand customer needs and behaviours. As a result, factoring companies can offer a more personalised service, which in turn can increase customer satisfaction and loyalty. In an era where personalisation is becoming increasingly important, the ability to tailor services to individual customer needs can be a key differentiator.