Product Customizer – implement any financial product

- 06.10.2022

- 4 min

Fintin provides a few flexible modules that adapt to the individual needs of financial service providers, car dealers, brokers and their clients. One of these modules is the Product Customizer, developed to build and implement selected financial services in a flexible and user-friendly way.

Product Customizer – how does it work?

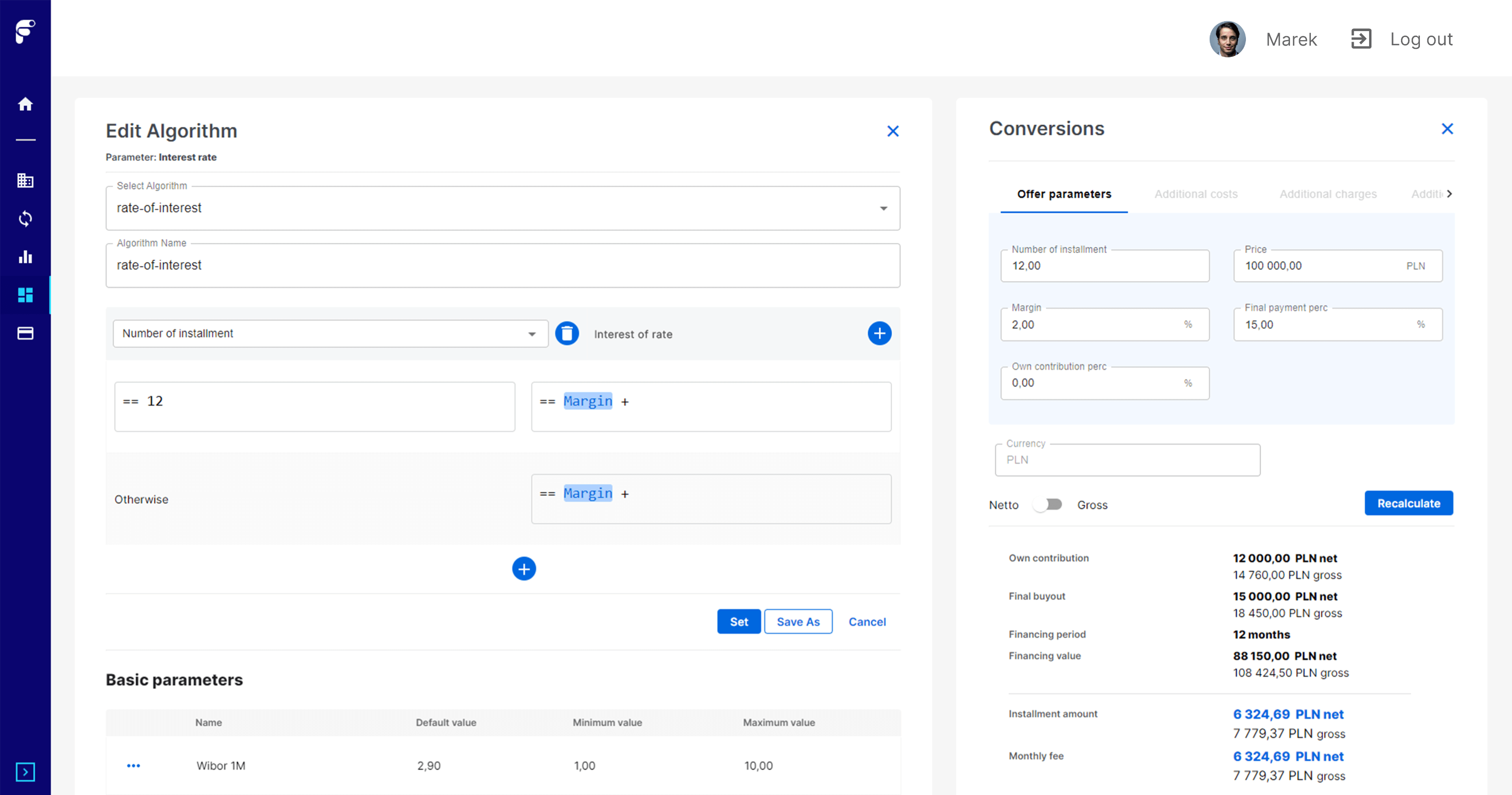

Product Customizer is one of the Fintin modules that helps you create flexible financial products. It allows you to implement your own parameters, algorithms and calculations.

It is a combination of three main configuration options that guarantee the ability to define specific offer parameters:

- Configuration of dictionaries – allows you to define any value dictionaries, e.g. a dictionary of financial products, allowing you to build your own parameters and offers from scratch.

- Configuration of parameters – is a selection of parameters of a specific financial product, consisting of three options: configuration of basic parameters, the configuration of additional cost parameters and configuration of additional fee parameters.

- Configuration of offer templates or additional products – defines a specific offer from the parameters selected in the previous stages, along with additional products and services.

What does our Product Customizer look like in practice?

Companies that want to implement a new financial product to their offer need to involve both business teams and developers. To properly configure a given offer and test it, it often must first be deployed in pre-production environments and then in the production environment. Therefore, the possibility of introducing a new offer or product can only occur with major development work.

Our Product Customizer allows you to build and implement any financial products without requiring a development team. It's an easily configurable and flexible module so that the business team can define selected parameters, algorithms and rules by themselves. Product Customizer is similar to programs such as Microsoft Excel; that's why non-technical people can easily navigate it. Also, this module offers the possibility of testing each element of the offer separately, as well as checking the entire offer in a specially prepared sandbox.

Main benefits you can gain with our Product Customizer

Product Customizer offers many possibilities, either as a separate module or combined with other modules available within the Fintin platform. Thanks to its unique functionalities, it supports omnichannel sales of financial products, allowing their parameters to be adjusted to the individual needs of customers.

The main features that make Product Customizer unique are:

- The possibility of an easy configuration of selected financial services so that users can adjust the offer to customers’ individual needs.

- A sandbox that guarantees the option of testing the selected online offer during configuration and deciding which financial services are actually needed.

- Flexibility management of the solution, which allows for testing and conversion of parameters within the system.

- Auditability that allows users to track all the changes introduced inside the system along with the information on who made each change.

- Integration with other Fintin modules – it can act as a standalone module as well as support selected modules offering the best possible digital experience.

- Supporting the omnichannel strategy in the financial sector by ensuring continuous and unlimited access to services within one channel.

The above features make the Product Customizer stand out from other financial products. It is not only a catalogue that allows you to select specific offer parameters but also a system that defines and converts these values by selecting the best possible option. As a result, both the insurer and the end customer can obtain a product that meets their individual needs.

Fintin – an innovative financial platform

Fintin helps leasing companies, insurers, car dealers, e-commerce companies and companies from other sectors tailor financing to customers' individual needs. It is a solution that allows for a comprehensive financing offer and for its full configuration using the available options.

With the help of flexible modules, which include ready-made, predefined processes and integrations in line with business domains, you can easily adapt the service to customer requirements. You can choose all available modules or just the ones you need, such as Virtual Dealer, Active Plugin, API Hub, Virtual Assistant, Task Manager, Intelligent Document Management module and an Open Banking aggregator.