Digital Assistant in finance – the integration of Fintin and Actionbot

- 28.03.2023

- 6 min

Financial institutions, such as banks, lessors or factoring companies, face a variety of problems due to the extensive processes their customers must go through when using their services. The solution is to use an intelligent conversational mechanism of the Digital Assistant module which is a part of the Fintin platform. It is based on the Actionbot engine, an AI chatbot that, in the friendly form of an online chatbot, guides the customer step by step, automating the entire process of the customer completing documents and applications.

What is the Digital Assistant module?

Completing applications and forms, particularly in the financial industry, can often be complicated, requiring customers to be knowledgeable about details, terminology or legal requirements specific to a particular product. Errors in documentation can lead to delays and even rejections of applications, which in turn negatively affects customer satisfaction and may result in them walking away. In addition, the workload of financial sector employees due to the need to handle many requests, often repetitive, affects the overall efficiency of the business.

To streamline the whole process, finance companies often use forms that the customer fills in online, selecting the relevant options and attaching additional documents. However, this method is not error-proof, in particular with descriptive fields. It requires additional contact with the customer, the completion of data and documents or more detailed information, e.g., on financial conditions. The solution here is conversation mechanisms based on artificial intelligence, which are similar in operation to instant messaging services familiar to customers, such as WhatsApp or Messenger.

Fintin, a financial platform, allows for the seamless implementation of conversational handling of requests thanks to Actionbot, a Digital Assistant using artificial intelligence technology and natural language processing (NLP) mechanisms.

The Digital Assistant is a module that allows the execution of applications in a new form, which can be implemented together with other Fintin modules such as the Task Manager or the Virtual Dealer, revolutionising not only the communication between the client and the financial institution, but also speeding up and streamlining the entire financing process, including after-sales service.

The use of Actionbot within the Fintin modules includes:

- the possibility of building processes on the conversational implementation of request forms or on a classic approach - depending on needs,

- implementation of processes related to data requirements,

- completion of necessary information based on user-friendly conversational mechanisms,

- completion of information by simple mechanisms, indicating improvements to the message in question,

- use of voice transcription for data recording.

How does Actionbot as Fintin's Digital Assistant improve customer service in finance?

In the financing industry, applications and forms filled in by customers often require 'manual' decreeing upon receipt from the customer, directing the matter to the relevant department of the company or assigning a specific employee to deal with the problem. This often requires obtaining additional information from the client, particularly when the application is completed without a consultant’s help.

Using the Digital Assistant in finance can minimise such problems – it will guide the conversation with the customer so that the form is completed with all the necessary information already at the stage of the first contact or data input. In this way, the time required to handle the entire process is reduced already to the level of identifying the customer's need and declaring the case – regardless of whether the final decision to proceed to the next stage is made by a company employee or is recognised automatically.

Thanks to the Digital Assistant module in the Fintin platform, we gain an intuitive, user-friendly interface in the form of an online chat, similar to the one from applications such as WhatsApp or Messenger. Importantly, the Actionbot-based Assistant will not only answer the most frequently asked questions, but it will also guide the customer step-by-step through the process of filling in forms and applications, as well as provide them with the necessary information, for instance on the terms and conditions of the contract or legal requirements.

Digital Assistant module in the Fintin platform:

- uses natural language recognition mechanisms,

- will guide the conversation and "extract" from the client the data necessary to decree the case already at the application registration stage,

- facilitates the automation of application handling, relieves customer service staff.

For example, a customer who wants to register a case for his lease, thanks to the Digital Assistant, does not have to wade through the classic complex application forms. The client simply selects a contract and the subject of the lease agreement and the entire process of completing the application is carried out in the form of a conversation, reminiscent of a live contact with a consultant. In addition, thanks to the use of voice recognition mechanisms, the Digital Assistant can act as a voicebot.

Due to the integration with the Fintin Task Manager module, back-office staff can also use the conversational mechanisms of such a case and, at the case completion level, see the relevant transcriptions of what the customer has recorded. The artificial intelligence embedded in the processes itself decrements the executed request or supports the employees in handling it.

In the case of factoring services, the Digital Assistant will help to handle frequently occurring questions or problems. It will enable the customer to obtain the expected information faster, both before entering into a factoring agreement, during the implementation of the agreement and in any subsequent contact with the financial institution.

This is particularly important in the case of a micro factoring product, where the number of queries weighs heavily on the sales or customer service department, as the customer portfolio grows by financing individual invoices rather than using the full transaction limits.

More examples of the use of Digital Assistants in the financial industry can be found in this article.

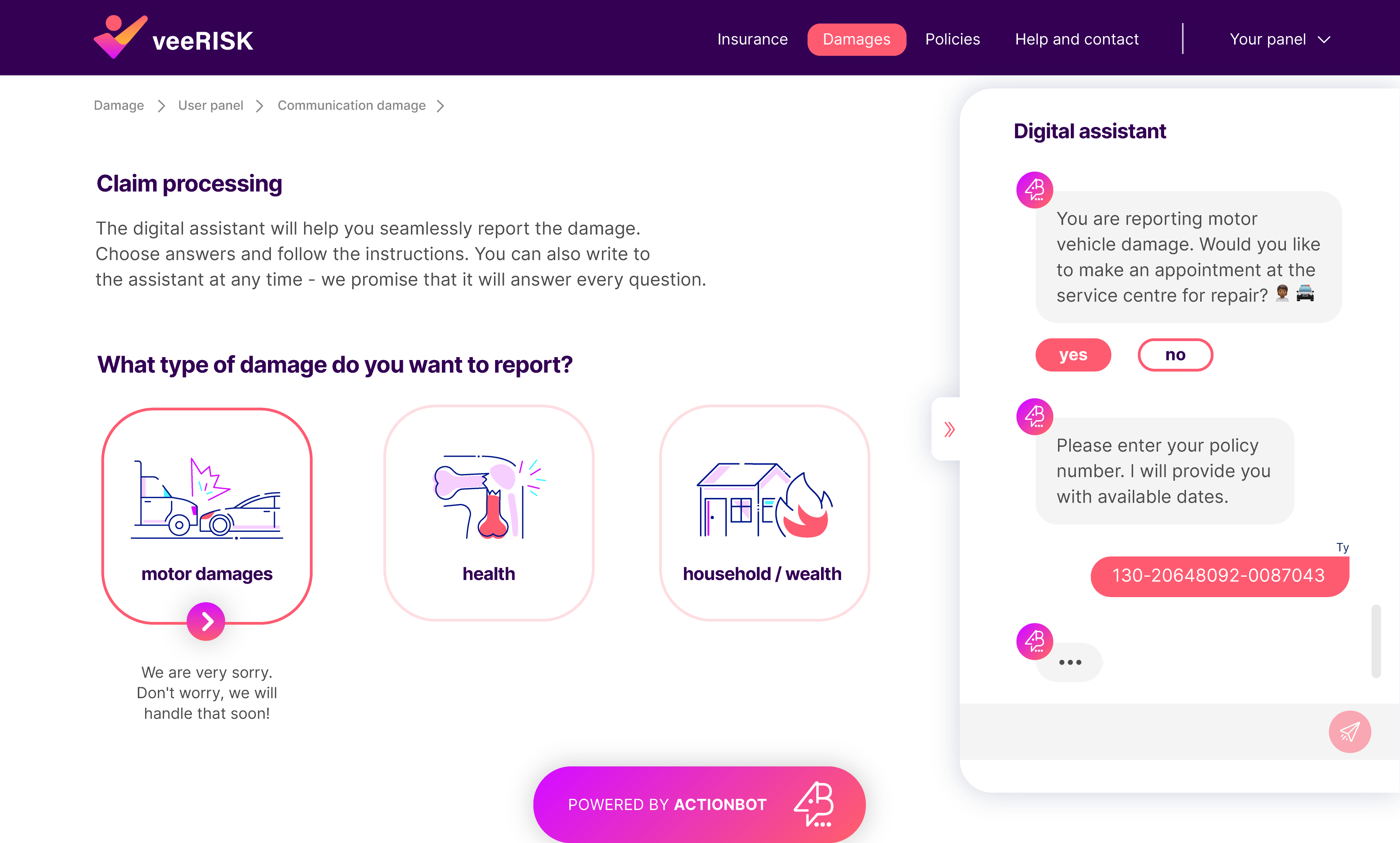

Actionbot for Generali Poland – how a Digital Assistant in finance revolutionised customer service

An excellent example of the use of conversational mechanisms in financial institutions is the use of Actionbot by Generali Poland, a division of one of the largest insurance groups in the world. The main objectives of the implementation were to improve communication with customers, automate processes (such as FAQ handling, claims handling or insurance policy selection) and reduce the number of calls to the call centers and conversations with consultants.

Watch the video demonstration made in cooperation with Generali Poland and IBM.

The virtual assistant implemented for a financial institution, named Leon, operates 24 hours a day. Leon cannot only answer customer queries in three main areas: claims, service policies and sales, but also chat on more than 140 different topics. For more complex queries, the chatbot redirects the customer to a consultant for quick resolution.

Just one month after Leon was implemented on the Generali Poland website, the number of user interactions with the chatbot was 2.5 times higher than previously with consultants. Leon handled almost 200 cases per day, reducing the consultants' workload to 5-20 conversations per day. As a result, it was able to decrease individual work by one hour per day and direct the attention of specialists to more complex enquiries and increase customer service efficiency, resulting in a saving of 120 man-hours of work per month.

It is worth mentioning that Leon won the second place in the Leader 2020 competition in the Insurance and Other Financial Institutions category, organised by Gazeta Bankowa.